Buoyant NatWest to return £2.1bn to shareholders

Every crisis presents opportunities. A contrarian strategy of ownership bank shares during the point of maximum gloom during a recession has often, but non e'er, been a good idea. It most definitely failed in 2008 when banks needed to raise majuscule and had to rely on Government bail outs. Only it has worked in previous recessions of the early 1990s, the Asian crisis 1997 and postal service Enron collapse 2002.

Subsequently many years of rebuilding majuscule, banks are clearly more resilient than the previous 2008 financial crisis and certainly are not experiencing the funding difficulties of 10 years ago as client deposit growth (NatWest reported a £39bn +22% annualised increase in customer deposits in the concluding 6 months) is up sharply in this recession. As discussed later, the current discounts to book value advise a skilful deal of bad news is already priced in.

In improver to the reported numbers, the analyst presentations and the questions banking company management answer can also allow insight to wider trends, for case the shift to digital transactions or customers on payment holidays (slide 20-21, Barclays Q2 presentation). This so called "voluntary disclosure" and narrative around the numbers is worth paying attention to for trends in the broader economy, consumer spending and other sectors, such as belongings companies and REITs, estate agents, retail, travel, restaurants and pubs.

Results

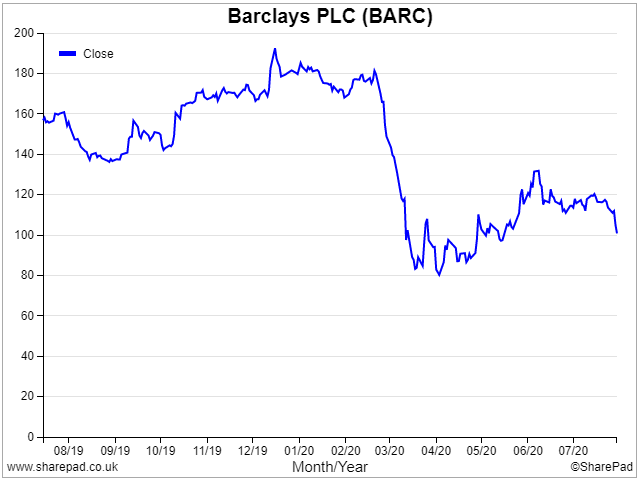

Barclays

Share price 104p

Market Cap £18.1bn

Barclays reported 29th July with acquirement £xi.6bn rising by 8% versus H1 last year, and credit impairments 2.07% of average loans. These numbers masked significant difference in the group's divisions, with the capital markets business (Stock-still Income Currency & Commodities) reporting income upward a very strong 83%. Unprecedented Central Bank and Government liquidity support have kept financial markets buoyant have benefited Barclays in the first half of the year.

But the cards and payments business reported revenue down 21% on the previous year. Impairments trebled to £1.3bn in the Consumer, Cards and Payments business, which reported a divisional loss of £614m. Barclays blamed falling card acquirement on consumers reducing spending on their credit cards and therefore lower carte balances. Defaults are harder to gauge at this point considering the bank has granted payment holidays on 121,000 UK mortgages (x% of the portfolio past value) and 157,000 credit cards (5% of the portfolio by value).

As an bated, it is rather dismaying to see that the Barclays Primary Executive rewarded for profits excluding Litigation and Conduct fines (page 104 of the Almanac Report). These are costs paid by shareholders, over which investors have far less control that management. It is also rather worrying from a shareholder perspective that these costs seem to recur every year, almost as a cost of doing business in the cyberbanking sector. Given that management incentives at Barclays do not include these 50&C costs, information technology seems probable that they will continue to recur.

In the outlook statement management advise that acquirement in the cards concern should brainstorm to recover, and that group bad debts should not rise from the levels reported in H1. A pick upward in consumer spending in the 2d one-half would benefit stocks similar JD Wetherspoons (961p, Mkt Cap £one,157m or smaller rivals such every bit Revolution Confined (16p, Mkt Cap £20m) and Loungers (129p, Mkt Cap 131m), perchance as well supported by the Government's "Eat Out to Help Out" discount scheme.

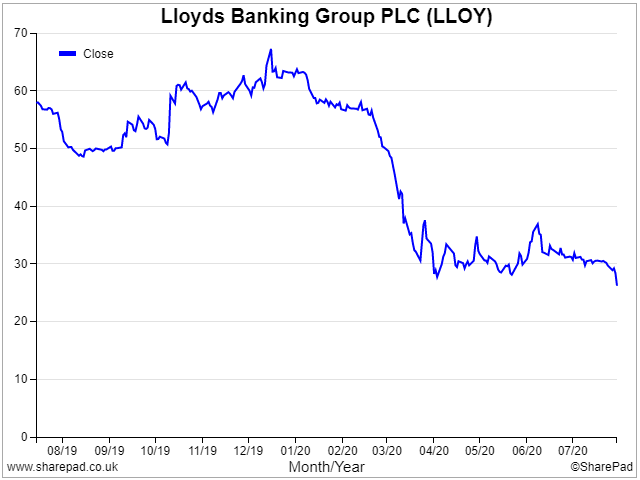

Lloyds

Share price 28p

Market cap £19.7bn

Lloyds reported 30th July with revenue £7.4bn, downwardly 16% versus H1 last year, and annualised credit impairments of ane.73% of average loans. The lack of a capital markets business meant that Lloyds reported a statutory pre tax loss of £602m in the kickoff half. In line with Barclays, the outlook statement suggests that credit impairments should fall in the 2nd half.

Profits in the Retail Bank barbarous 90%, every bit revenue fell 10% and harm charge up 4x to £2.1bn. Unfortunately Lloyds failed to benefit from diversified universal banking model, because the Insurance and Wealth (the old Scottish Widows business) division saw revenue fall 29% and underlying profits downwards 42%.

The shares opened sharply down and were trading 7.five% lower following the conference call as analysts questioned how the bank would achieve returns above cost of disinterestedness, if the bank's guidance for the 2020 Total Year Net Interest Margin of 2.40% failed to improve in future years.

Antonio Horta Osario the Chief Executive has announced he will exist stepping downward next year. Although touted as a talented individual there has been some controversy over the size of his rewards in the past. Investors in Lloyds shares may exist rather disappointed that the Principal Executive'southward long term incentive has paid out on average 70% of maximum opportunity and he has been paid £56m in unmarried figure remuneration since he joined the depository financial institution in 2011 and in add-on has been rewarded with over 40m shares. Yet the share price has drifted up from below 50p to back downwards to below 30p today. Even before the stockmarket started falling due Covid concerns, Lloyds shares were back where they were in 2013 despite the Main Executive mostly striking his targets. This implies that management incentives were non well aligned with share price performance over the last 7 years. The whole idea of Long Term Incentives is to link rewards to the company'south performance over the longer term.

Lloyds, which is a 3rd of the UK mortgage market made encouraging noises about activity in the U.k. housing market picking up following the end of lockdown. Royal Bank with a market share of x.5% likewise talked virtually a recover and gaining market share in this area. Smaller cap estate agents that reported in early August such as Yard Winkworth (146p, Mkt Cap £18m) and Purplebricks (60p, 186p) which has been desperately striking but whose share prices are beginning to recover, helped non just past the availability of bank finance just also the Chancellor's change of stamp duty threshold from £125,000 to £500,000 until 31 March 2021. Interestingly Purplebricks Senior Independent Non-Exec Manager Simon Downing purchased 500,000 shares at a price of 57.5p per share on half-dozen August 2020.

Also ULS Engineering (62p, £40m Market Cap) the online conveyancing company (which I own and have recently increased my position in) should benefit from this trend.

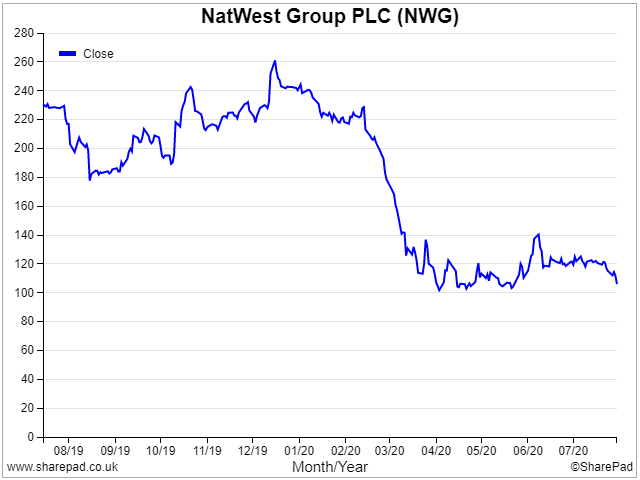

NatWest (the bank formerly known as Regal Bank of Scotland)

Share toll 110p

Market cap £xiii.4bn

NatWest reported 31st July, with acquirement down 18% to £5.8bn in H1 and a loss of £770m on a statutory basis. Excluding the one off benefit of a Eye Eastern depository financial institution disposal last year, acquirement would accept been down v% on an underlying ground.

The comparisons versus half yr 2019 were also buoyed past a helpful release of a £250m Payment Protection Mis-Selling provision equally complaints were lower than previously predicted. Absent this, and the statutory loss in the first half would have been over a billion pounds. Like to Barclays, there were diverging trends with the retail and commercial businesses falling 9%, while NatWest Markets was upwardly 44% on an underlying basis. Despite this strong markets functioning, the NatWest Markets barely made a profit as costs remained loftier and only managed to report a return on equity of 0.viii%.

The H1 group harm charge was £two.9bn or ane.72% of client loans. Direction guidance is for this to fall in the second half. From a consumer perspective management talked near a 10% bounce in debit and credit card spending July v June.

NatWest has £40bn of commercial property lending on its rest, and the commercial bank saw a trebling of impairments in Q2 5 Q1 to £1.4bn as the bank marked down its macro-economic assumptions merely likewise adjusted for meaning falls in real estate valuations. This suggests investors may want to await before trying to phone call the bottom in commercial property REITs or stocks such as Hammerson (which announced it is to raise £552m via a rights outcome, following a first one-half loss of £1.1bn).

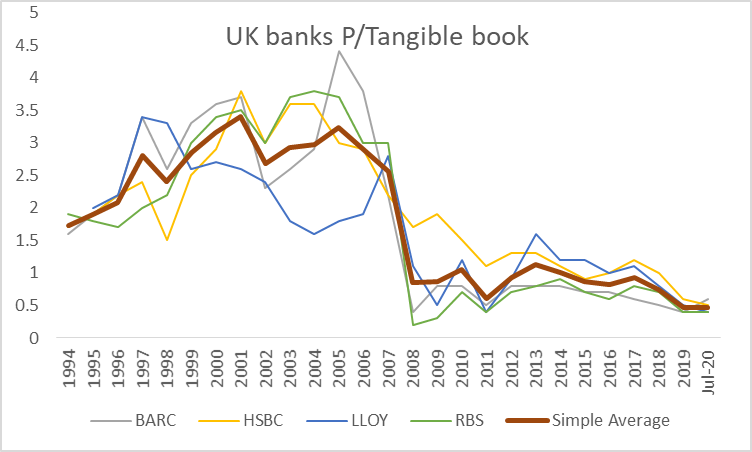

Share prices and valuation

The 4 clearing banks (Barclays, HSBC, Lloyds and NatWest – formerly Royal Bank of Scotland) share prices are trading close to 20 yr lows, both in terms of absolute share price and valuation (price to tangible book). Virgin Coin, Metro Bank have been excluded from the chart below considering their history does not get back far enough to show performance through previous recessions.

Source: SharePad – Downloaded from SharePad into a CSV file, using the "share" push button on the far right of the screen.

The thick dark-brown line shows that the sector average valuation peaked in 2001, just equally the TMT bubble burst. Difficult to believe, merely dorsum so investors (correctly) causeless that banks were relatively defensive compared to the hugely hyped and overvalued TMT sector. Lloyds valuation peaked earlier this in the belatedly 1990s when information technology was briefly the biggest (and most profitable) banking concern in the world by market place capitalisation, whereas RBS and Barclays enjoyed the tailwinds of uppercase markets businesses peaked afterwards in 2004.

The tabular array beneath likewise shows fundamental data for the Great britain clearing banks which accept simply reported, plus HSBC and Standard Chartered which I may comment on in a future slice.

Bank analysts ofttimes prefer cost / internet tangible book as a ratio over the p/due east, considering banking concern earnings can exist so volatile. For example, SharePad shows HSBC currently trading on a p/e of almost 180x, despite the share toll trading effectually the levels it was during the Asian crunch in the belatedly 1990's. That is, the "e" of the p/e ratio is currently suppressed leading to an artificially high p/e. Similarly a p/e ratio would not accept been much good for valuing NatWest / Regal Banking concern of Scotland during the 8 consecutive years of losses the bank reported post 2008 financial crisis.

The table in a higher place also shows the substantial price to cyberspace tangible book value discounts (NTAV) and the performance of bank share prices since the cease of February this yr when the stockmarket peaked pre-Corona. I have sorted the banks by this percentage change column, to show that Lloyds has been worst hitting downwardly 45% and perhaps surprisingly Barclays and Standard Chartered take been the to the lowest degree worst, still down circa 30%.

Strategy and targets

With depository financial institution valuations at such large discounts to volume the investors are clearly sceptical of target returns banks have previously announced. At the start of the twelvemonth UK banks had medium term target Return on Tangible Equity of above 10%, as the table higher up shows.

| Targets | CET one | RoTE | |

| Barclays | 13.v% | > 10% | |

| Lloyds | 13.five% | 12-13% | |

| NatWest | 13-14% | 9-11% |

Pre 2008 many bank Primary Executives were rewarded for double digit EPS growth (notably HBOS, Northern Rock and RBS) with disastrous results, so the change is clearly an improvement from a shareholder perspective. Banks capital ratios are well above levels reported x years agone, meaning that unlike many other sectors, we are unlikely to see distressed rights issues in the cyberbanking sector. Instead the worry is that banks are likely to report returns well below their medium term targets in FY 2020 and across. Britain banks accept a long history of being over optimistic with their guidance to investors, and it appears the banks central scenarios and modelling assumptions are for no further deteriorating in the economy in the second half.

The hope is that now that direction incentives are weighted towards strong uppercase ratios (core equity tier ane capital) and increasing returns earned on the uppercase (Render on Tangible Equity) equally well every bit more quality measures (customer complaints, Net Promoter Score, gender diversity to name a few) the better alignment with customers and shareholders may mean that the bad news is in the price, and we are likely to see improvements in expectations from here.

If these medium term RoTE targets are broadly doable, then all 3 banks appears significantly undervalued.

Summary

Despite the disappointing share price reactions on the day, expectations for UK banks have sunk so low that they now qualify equally unloved "deep value".

Rather than bad debts, many questions to management on the analyst calls focused on the outlook for peak line, and whether banks can manage costs in a difficult revenue environment. Particularly every bit low margin mortgages seem to be recovering faster than college APR unsecured balances (which makes sense from a consumer perspective, paying downwards expensive credit).

But with substantial discounts to net tangible book value, low expectations are priced in. Dividends and buybacks have been suspended, but the United kingdom regulator volition consider allowing them to resume in Q4. The read-across from management to other sectors of the economy suggests that companies that rely on housing market activity (such as manor agents) are more likely to see a positive surprise than those in commercial belongings.

Bruce Packard

This article is for educational purposes only. It is non a recommendation to buy or sell shares or other investments. Do your own research earlier buying or selling whatever investment or seek professional financial advice.

Source: https://knowledge.sharescope.co.uk/2020/08/13/uk-banks-in-the-eye-of-the-storm/

Posted by: cartervoiled.blogspot.com

0 Response to "Buoyant NatWest to return £2.1bn to shareholders"

Post a Comment